If your credit score is all bewildered and out of sync, then you might be missing out on some of the most significant financial opportunities. Some of these might include applying for a low-interest loan, getting better terms on the said loan, and getting admission in some of the most vibrant advertised schemes offering bonuses, cashback opportunities, and more.

If you have a bad credit score, then it means you don’t qualify for any of this and thus might face a hard time, along with penetrating the eyes of the lenders/banks when asking for a car, education, or home loan.

Bad credit might require some time for recapitulating or rebounding to its initial state, it might not happen overnight, and that is why you need to be real patient with the process. The time to start repairing your credit score is now, and you don’t want to subject it to a later date.

Anyway, if you want to repair your credit score and want to do it right, then follow these incredible ways to do so.

Review Your Current Reports

The first thing that you need to do is to review your current credit reports. You can do that easily by requesting a fresh copy of your report from various credit bureaus such as TransUnion, Experian, and Equifax. You can ask for a free copy of your credit report from any of these.

You have to sign up with these services to get your hands on a credit report copy once you do study it briefly and try to understand your current credit score situation.

Disputing Incorrect Late Payment Entries

When seeing your credit report, look for the entries that are marked as late payment. It is possible that you might have paid your mortgage on time, but for some reason, your lender reported it as a late payment.

Mistakes happen, there is no need to point fingers; what you can do is to dispute these late payments; this is applicable for both current accounts and for those that have been closed earlier. Study these errors in detail and try to sort all of them to make your credit score look better.

Be Seated at 30% Credit Utilization or Less

After payment history credit utilization is the most important factor for evaluating your credit score. It refers to a sizable portion of your credit limits which you might be using at any given time. To keep this thing in check, you are required to pay your credit card balances in full each month.

If this is something that is too much to ask, then make sure that your total outstanding balance hovers at 30% or less. Another way of taking care of it is to request your concerning credit card company to increase the limit online as this way, you will remain way below the utilization rate and thus not so far behind on payments.

Make the Most of Your Credit History

If you have a thin credit file, then it simply means that you don’t have enough credit history, and that too is not great as with such low data, a credit score simply can’t be generated. Millions of Americans have the same issue, but lucky for you, there is a way for you to fatten up your credit history file.

There are programs out there such as UltraFICO and Experian Boost that calculate your banking data and transaction history for the sake of creating a valid FICO rating.

Consolidate Your Debts

Another reason why your credit score is in deficit is due to the number of outstanding debts that you currently have. Have you ever considered clearing these out? Well, everyone does, but the lack of funds to do so is the primary obstacle people have to cross, and this is where a debt consolidation loan comes into play.

You are eligible to apply for such a loan to tackle all those outstanding debts and the best thing about this is you will then only have a single loan to worry about. This, in turn, wholeheartedly improves your credit score.

Track Your Progress With Credit Monitoring

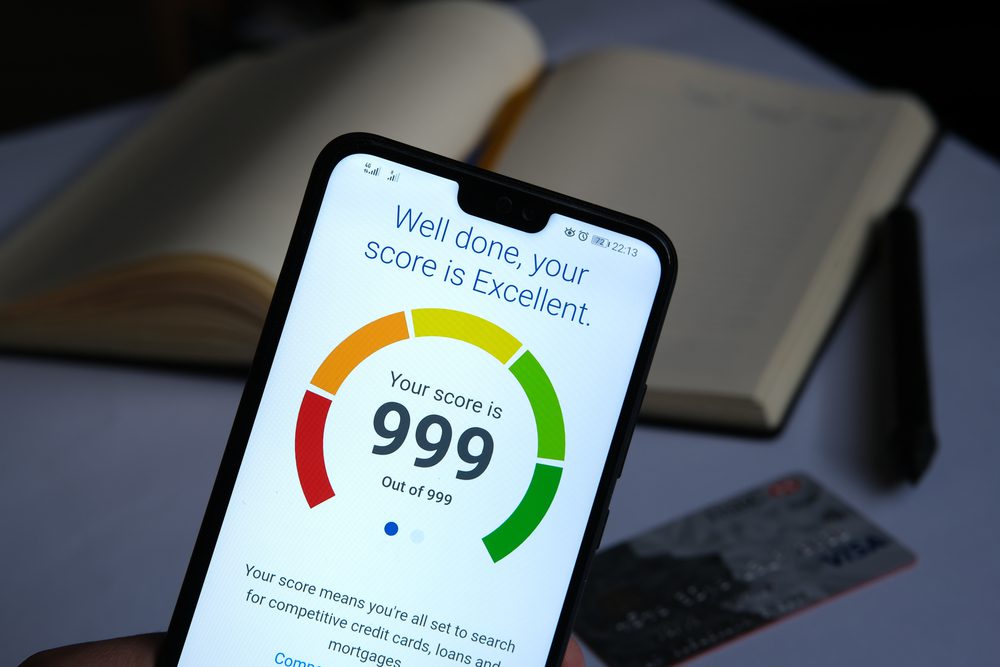

There are a variety of credit monitoring services out there you can use to monitor your credit score and how it changes over time. This will give you an incredible insight into how your credit score has changed over time, what were the reasons your credit score plummeted down, and what you can do to improve it.

You might also get access to your monthly credit scores that are updated regularly.

On the bright side of things, these services also help you to prevent fraud and identity theft, such as if a new credit card account that you haven’t opened has been operating under your name, then you will be able to stop its operating in real-time by calling the concerned authorities.

Pay High-Interest New Credit Accounts First

The overall period of credit in your possession is a strong factor in the determination of your credit score and, in the same way, the interest rates at which you have managed to secure an accounting matter for your bank account.

Therefore if you could prioritize the payment of the high-interest loans first, then it would help to stabilize your credit score significantly. In the same way, it is essential that you move onto the next one based on the age of the account. You want to pay off the newest ones first to make your credit score homogeneous and consistent.

Get Authorization For Using Your Spouse’s Credit Card

Say your spouse has an immaculate payment history and is in possession of a credit card with little or no balance whatsoever. If they authorize you as one of the users for that specific credit card, then given this authentication, you will already be able to take advantage of their credit score and payment history.

This, in turn, is going to boost your own credit score, and that is why many people use this old tactic in the book to improve their credit score on time.

Also, a point to note here would be to tread lightly and with caution as if your spouse makes a late payment or anything of the sort to hurt their credit score, then yours would show a negative trend automatically.

Ready to repair your credit score?

If you want to make your financial life a tad less tiresome and challenging, then improving your credit score is the only way to make it happen. Most people would go around tactics and methods that don’t work only to try those that do. You are given an opportunity here to try these effective ways mentioned above to repair your credit score for a healthy and sustaining financial future.

You might also like: 10 Money Saving Apps You’ll Want to Download Today